Payroll Settings

In payroll settings, you can configure all your payroll pre-configurations like allowances, deductions, EPF, ESI, professional tax and loans

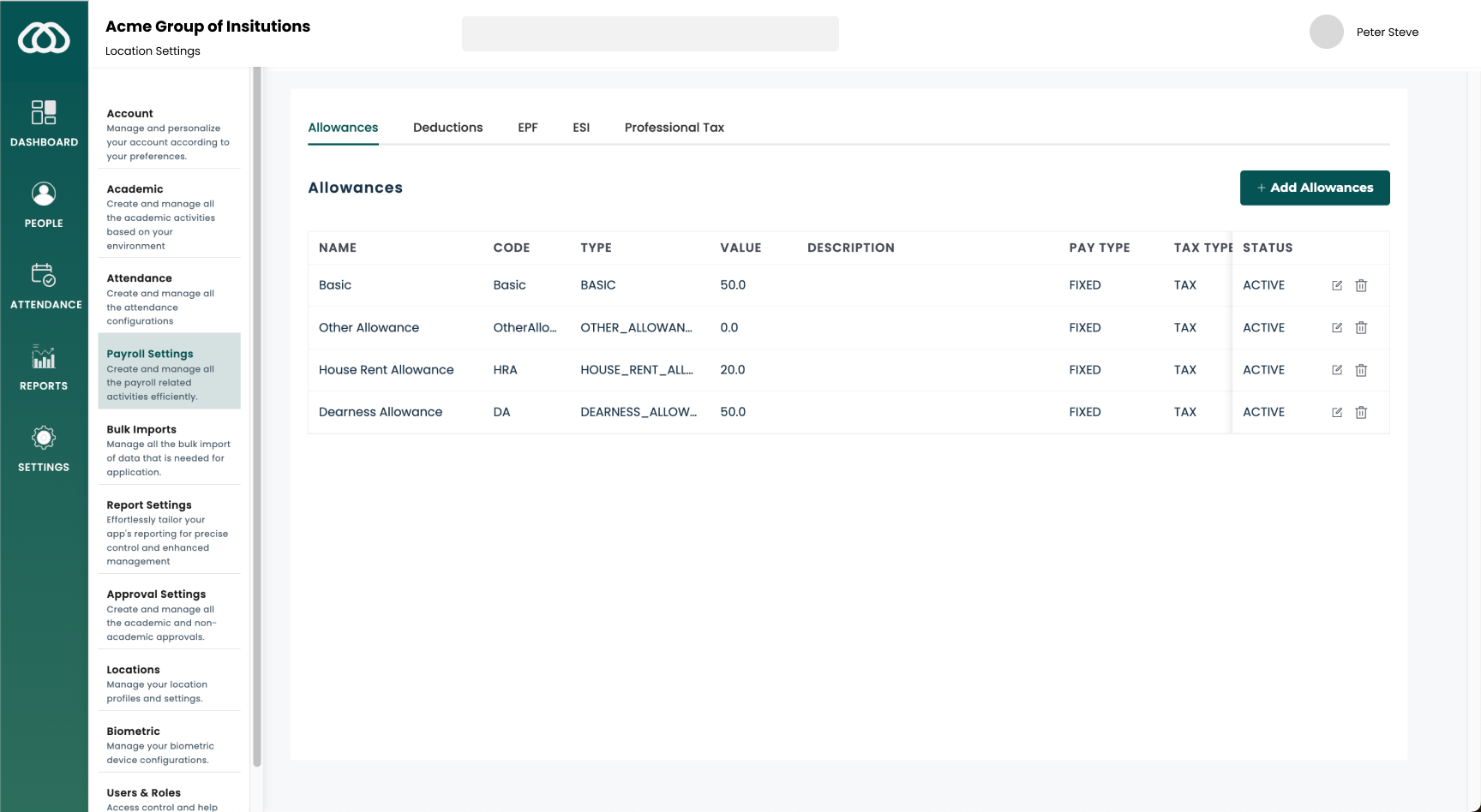

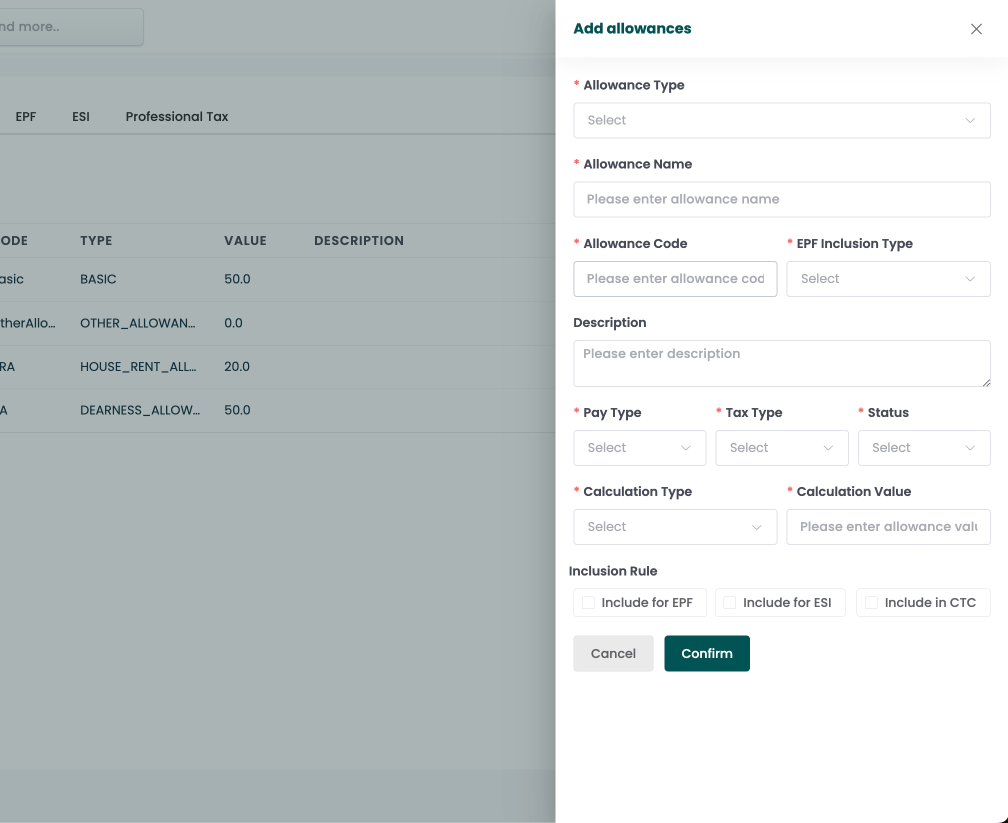

Allowances

Allowance setting allows you to add different allowances variables based on their organization.

- Go to settings > Payroll > Allowances

- Click on Add Allowances

- Fill the required fields like allowance type, allowance name, code, inclusion type etc..

- You can also set the inclusion rules if needed like include this for EPF, ESI and CTC

- Click Confirm

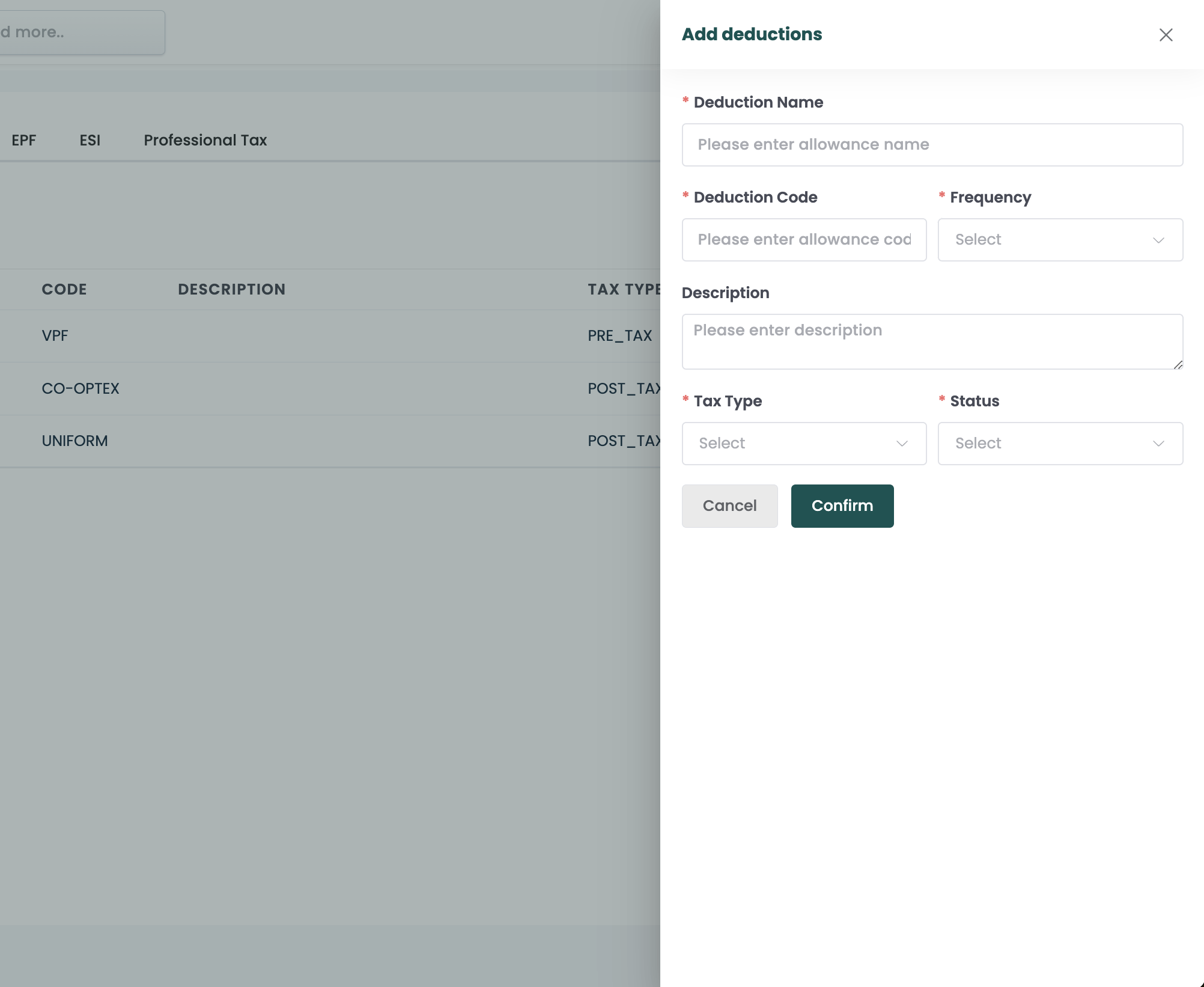

Deductions

Holiday setting allows you to add different deduction variables based on their organization.

- Go to settings > Payroll > Deductions

- Click on Add Deduction

- Fill the required fields like deduction name, deduction frequency etc..

- Click Confirm

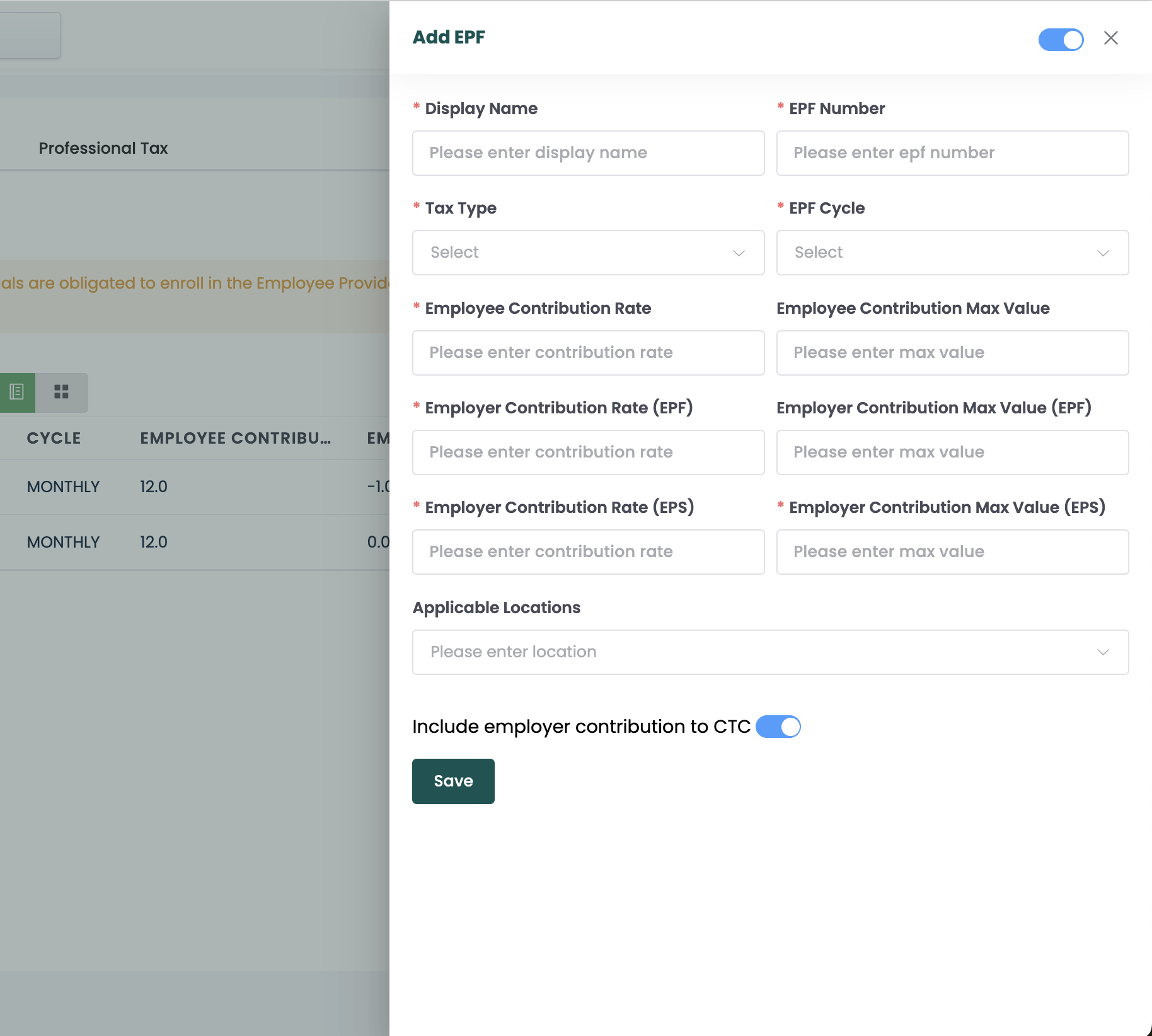

Employee Provident Fund

EPF settings allow you to add EPF configurations for the organization. One unique feature that XendCampus offers is the ability to create EPF configurations for each location individually if you are using a multi-location model, or create different EPF configurations for each application ID if you are using a multi-application model.

- Go to settings > Payroll > EPF

- Click Add EPF

- Fill the required fields like epf number, cycle, tax type, contribution rates etc..

- setting EPF for each location by using applicable locations

- Click Confirm

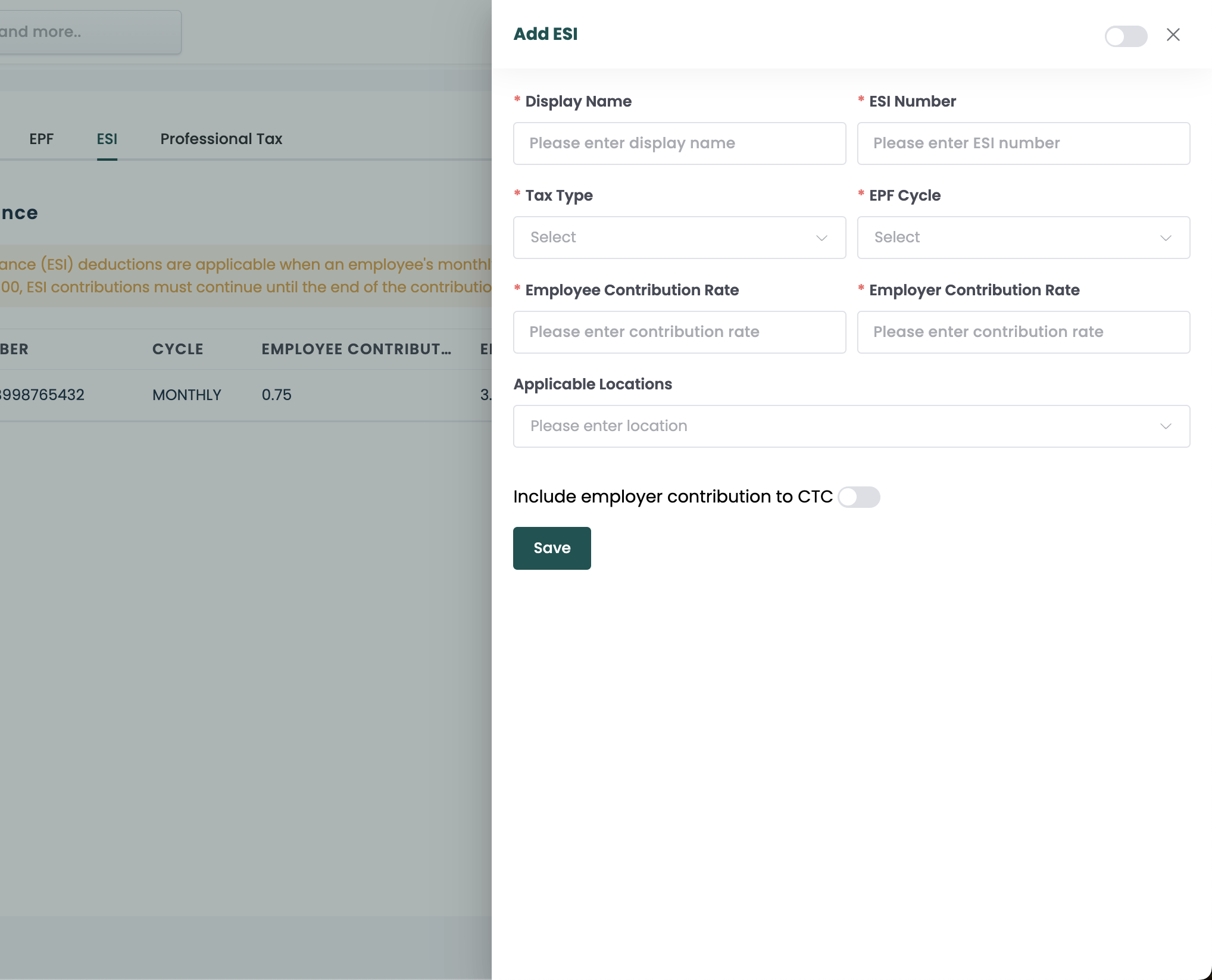

Employees' State Insurance

ESI settings allow you to add ESI configurations for the organization. One unique feature that XendCampus offers is the ability to create ESI configurations for each location individually if you are using a multi-location model, or create different ESI configurations for each application ID if you are using a multi-application model.

- Go to settings > Payroll > ESI

- Click Add ESI

- Fill the required fields like esi number, cycle, tax type, contribution rates etc..

- setting ESI for each location by using applicable locations

- Click Confirm

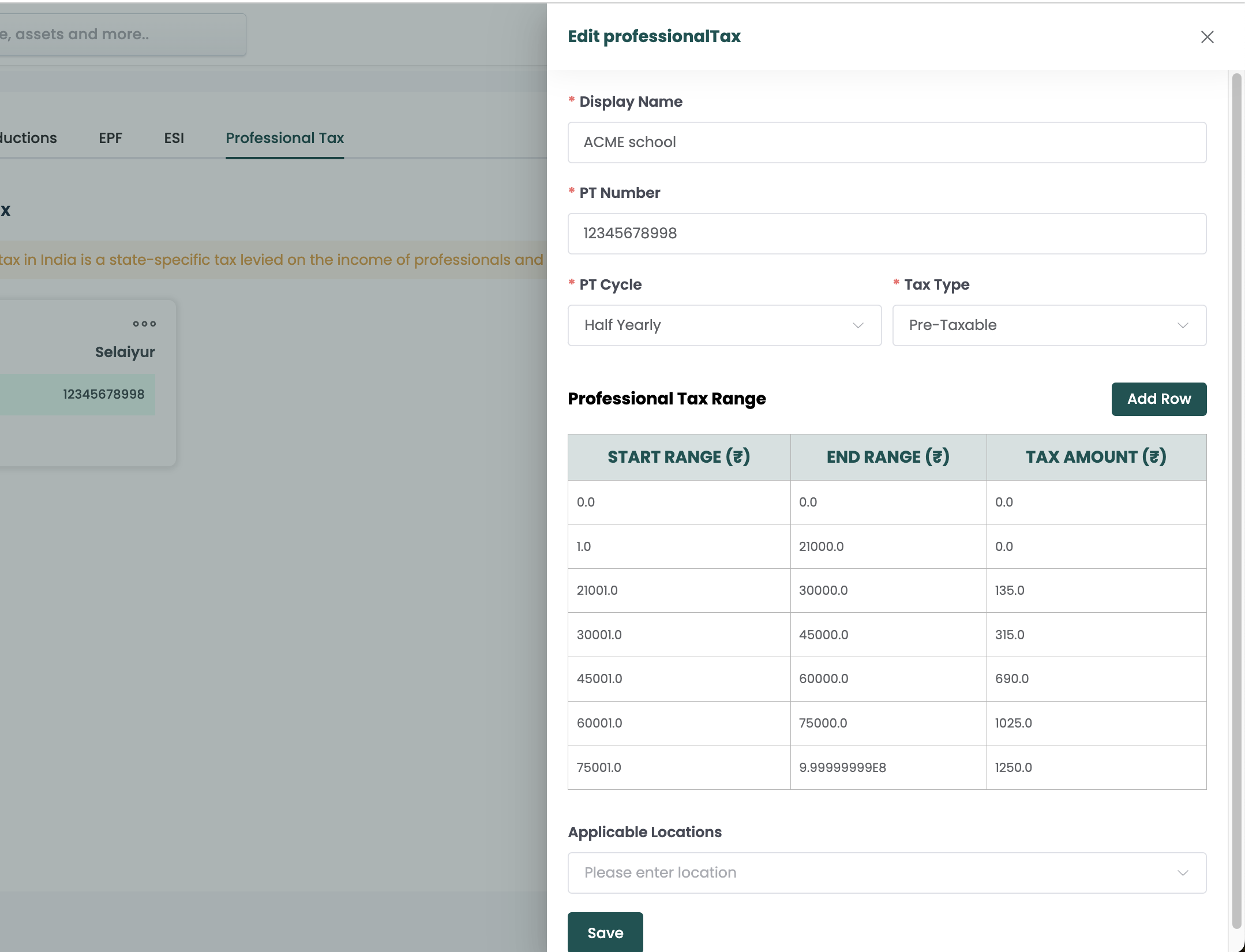

Professional Tax

Professional Tax settings allows you to set the tax value with cap which will automatically deduct on employee payroll. One unique feature that XendCampus offers is the ability to create Professional Tax configurations for each location individually if you are using a multi-location model, or create different Professional Tax configurations for each application ID if you are using a multi-application model.

- Go to settings > Payroll > Professional Tax

- Click Add Professional Tax

- Fill the required fields like pt number, cycle, tax type, tax ranges etc..

- setting prpfessional tax for each location by using applicable locations

- Click Confirm